Utah PTA supports 2020 General Election Constitutional Amendment G

During the annual Business Meeting of the Utah PTA Advocacy Conference, Utah PTA members voted, as part of their 2020-2021 Legislative Priorities to support Constitutional Amendment G. This amendment will be presented to Utah voters on the 2020 General Election Ballot.

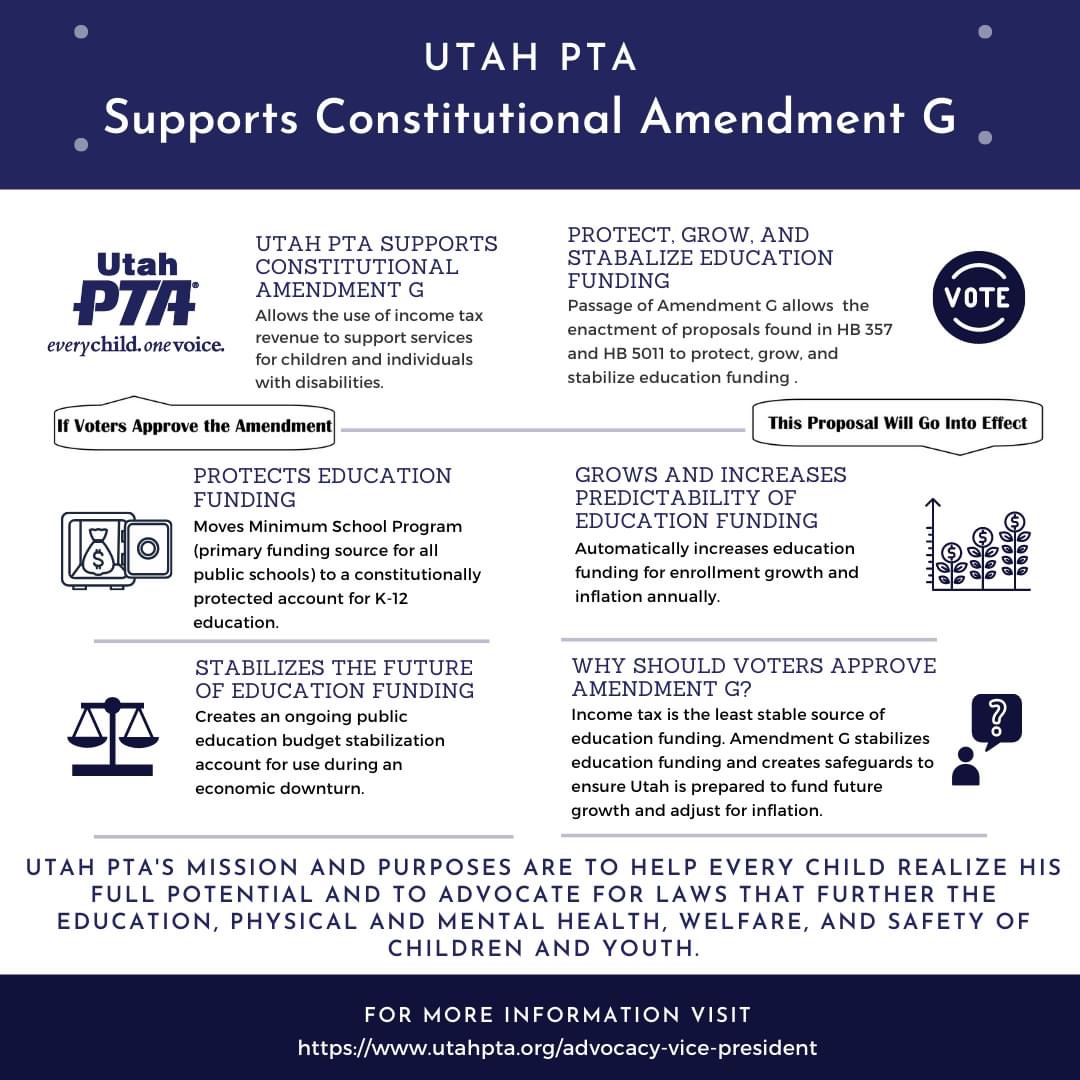

Constitutional Amendment G states, "Shall the Utah Constitution be amended to expand the uses of money the state receives from income taxes and intangible property taxes to include supporting children and supporting people with a disability?" Utah PTA's mission and purposes are to help every child realize his full potential and to advocate for laws that further the education, physical and mental health, welfare, and safety of children and youth. Securing funding for services for children and for expanding education funding supports the mission of Utah PTA to advocate for the whole child.

What is the purpose of this Amendment?

Constitutional Amendment G will provide additional supports for children while also allowing laws that were passed in the 2020 legislative session to go into effect that are designed to protect, grow, and stabilize current and future public education funding. Over time Utah's unrestricted General Fund is not able to provide for all the programs currently outlined in statute.

Utah's Constitution currently states that "All revenue from taxes on intangible property or from a tax on income shall be used to support the systems of public education and higher education". (Article XIII, Section 5. (5)) Amendment G will allow services for children and people with disabilities in addition to the systems of public education and higher education to be funded with income tax.

Why A Constitutional Change Now?

State legislators believe there is a structural revenue imbalance. This imbalance manifests itself in the following ways:

- There is not sufficient sales tax revenue to sufficiently fund state needs.

- There is excess funding in income tax, which by the state constitution, is designated for public education (K-12 education & higher education)

- There is a need for changes that provide for a structure with increased flexibility for legislators.

What does Amendment G mean by “services for children and people with disabilities?”

It has been suggested that the following programs that have been funded by the General Fund may be moved to the Education Fund:

- Children’s Justice Centers

- Child Protection Services

- Guardian ad Litem

- Children’s Health Insurance Program (CHIP)

- Children with Special Health Care Needs

- Juvenile Justice Services

- Temporary Assistance for Needy Families

- Immediate Care Facilities for the Intellectually Disabled

- Services for People with Disabilities

- Mental Health Centers

- Substance Abuse Services

- State Office of Rehabilitation

Why would Utah PTA support an amendment that could affect education funding?

Last spring during the legislative session, Utah PTA leadership was invited to a meeting with Senator Ann Millner, State Superintendent Sydnee Dickson, and Brittney Cummins from the Utah State Board of Education. They were seeking our feedback on the creation of a new system for funding public education.

With our support and that of other education stakeholders, HB 357 was introduced as companion legislation to SJR 9, the law that created Constitutional Amendment G. The companion legislation, which only goes into effect IF the constitutional amendment passes, places a base budget, enrollment growth, and an inflationary increase into the Uniform School Fund, a constitutionally guaranteed fund for K-12 public education. It also creates the Public Education Economic Stabilization Restricted Account for use in an economic downturn.

Even though we have had a constitutionally guaranteed funding source, we have never had a distribution method. Historically, each year education stakeholders arrive on Capitol Hill prepared to battle for education funding. Therefore, we ask for increased funding to the Weighted Pupil Unit (WPU), which is flexible funding that goes directly to the districts and charter schools to fund the minimum school program, and until 2020 we have also had to beg for enrollment growth.

Utah needs a public education funding method – just having the funding source has not provided the resources necessary for our students.

What does this have to do with tax reform?

The General fund provides for healthcare, public safety, courts, transportation, mental health, substance abuse treatment, and other social services for Utah's most vulnerable families. The General Fund is suffering in two important ways, one is changes in consumer habits, as Utah's residents spend more on services over products, and the second is transportation earmarks, which restrict over $600 million of sales tax for transportation purposes only. Utah's legislature has been trying to pass tax reform to bring more revenue into the general fund for the past few years.

On the 2018 general ballot was a "non-binding question" that asked if voters were willing to pay an additional ten cents per gallon of gas. This was sold to get more money for education. The promise was that by putting more money into the gas tax for roads, transportation money would be freed up for the general fund, which could pay for higher education, which would provide more funding for public education. This convoluted funding method was voted down by the voters.

In the 2019 general session legislators presented HB 441, which attempted to tax numerous new services. This bill received immediate negative reactions and quickly died. After a summer of "listening tours", the legislature regrouped and held a special session in early December 2019 where they passed HB 2011. This bill attempted to balance the budget by decreasing the education fund by $600 million, increasing the sales tax on grocery food, and increasing the gas tax.

Utah PTA was strongly against HB 2011 as it did not have a plan for funding public education, and it was hurting our most vulnerable families by increasing the sales tax on food and gas. Utah PTA voiced public opposition to this law and requested that the legislature provide a system for funding education before they moved money from the education fund. A successful referendum by Utah voters against HB 2011 eventually led to its repeal during the first week of the 2020 Session.

Utah PTA strongly supports HB 357 and the distribution method it puts into place to grow public education funding. We recognize that the legislature believes more flexibility is needed and support Constitutional Amendment G to provide for the well-being of children and to protect public education funding through the constitutionally guaranteed Uniform School Fund.

Additional Resources:

S.J.R. 9 Substitute -- Proposal to Amend Utah Constitution - Use of Tax Revenue

H.B. 357 Second Substitute -- Public Education Funding Stabilization

H.B. 5011 -- WPU Value Increase Guarantee